Appearance

Government Shutdown: Is SQQQ Your Market Hedge?

Overview

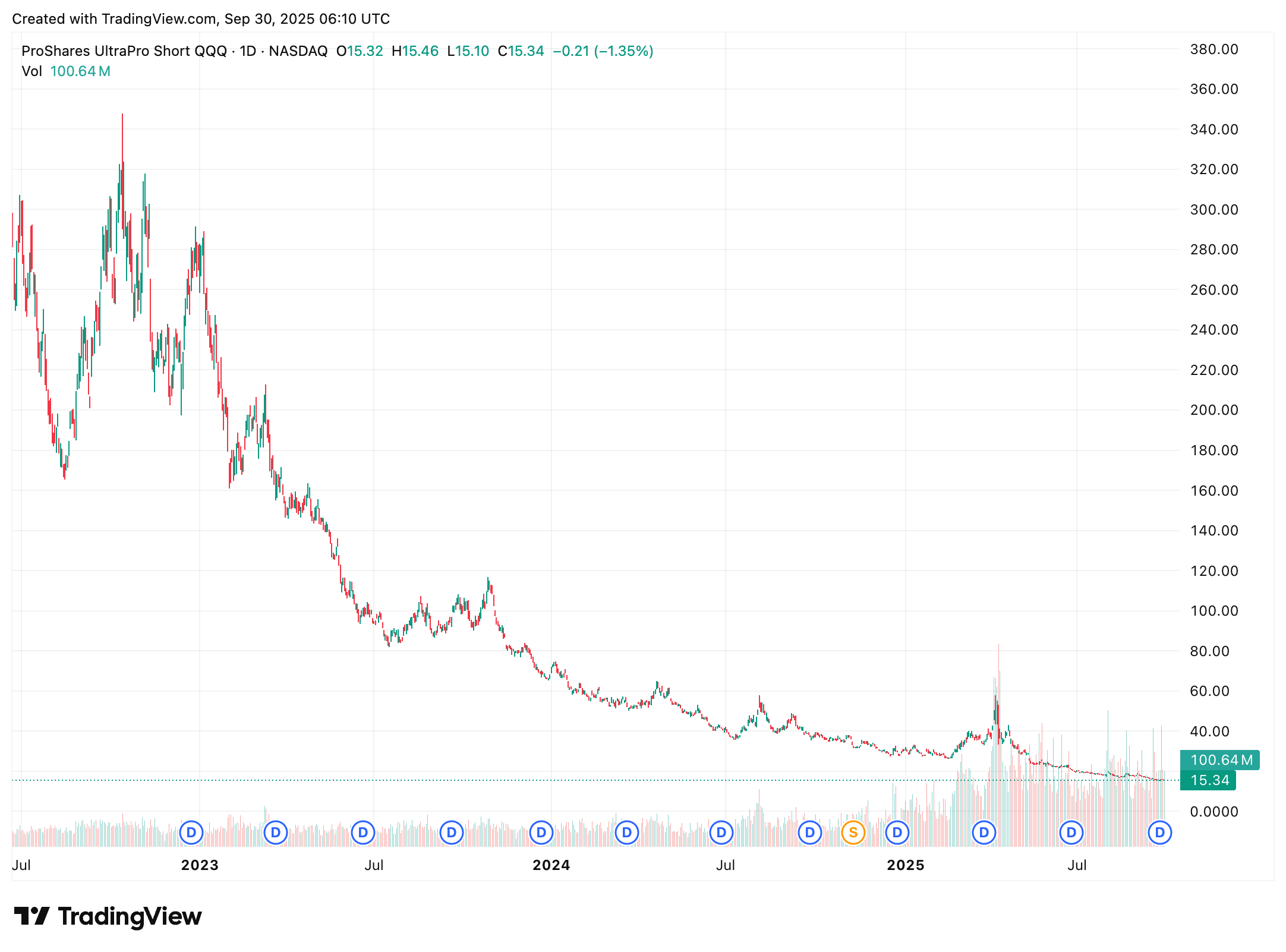

SQQQ is a 3x inverse ETF designed to deliver approximately −3 times the DAILY return of the Nasdaq-100 (QQQ). It’s a short-term trading or hedging tool—not a buy-and-hold investment—because it resets daily and is subject to volatility decay. Use it when expecting near-term downside or for tactical hedging on tech-heavy risk.

Key takeaways

- Best for short-term trades or hedges during persistent downtrends in QQQ.

- Avoid in choppy, sideways markets—daily compounding can erode returns.

- Size positions by risk (stop distance), not by maximum leverage or “gut feel.”

- Rebalance frequently; SQQQ’s daily reset makes longer holds path-dependent.

What SQQQ is (and isn’t)

- Is: A −3x daily inverse vehicle on QQQ for tactical bearish exposure.

- Isn’t: A long-term short on tech. Holding through chop causes decay and fees.

| Day | NASDAQ Return (R_NASDAQ) | SQQQ Daily Return (R_SQQQ) | SQQQ Daily Return Factor (1 + R_SQQQ) | Compounded Return Factor (Cumulative) | Total Compounded Return |

|---|---|---|---|---|---|

| 1 | -2.00% | 0.06 | 1.06 | 1.06 | 0.06 |

| 2 | -1.00% | 0.03 | 1.03 | 1.0918 | 0.0918 |

| 3 | 1.50% | -0.045 | 0.955 | 1.042669 | 0.042669 |

When SQQQ tends to work best

- Persistent risk-off regimes: QQQ below 200-day MA, lower highs/lows.

- Rising real yields and strong USD pressuring high-duration tech.

- Earnings revisions rolling over for mega-cap tech.

- Widening credit spreads; rising VIX in backwardation.

- Nasdaq new lows exceeding new highs.

When to avoid or keep tiny

- Rangebound chop around major moving averages.

- Binary events with gap risk (earnings, CPI, FOMC).

- Strong risk-on rallies due to potential short squeezes.

Decision checklist

- Trend: QQQ below 200-day MA; 50-day MA sloping down; weak breadth.

- Momentum: MACD bearish cross; RSI < 50.

- Volatility & credit: VIX > 20 and rising; HY spreads widening.

- Macro: 10y real yields rising; DXY uptrend; negative earnings revisions.

- If 3–4 align bearishly, SQQQ has higher probability of success.

Entry and exit rules (example playbook)

- Timeframe: Use 1H for timing, Daily for regime analysis.

- Entry: On QQQ breakdown with bearish MACD and RSI < 50 or failed rally into 20/50-day MAs.

- Stop-loss: Place just beyond recent SQQQ swing or 1.5×ATR(14).

- Take profit: Scale at +1R, trail with 2×ATR, or exit on QQQ bullish reversal.

- Holding period: Days to a few weeks; reassess daily due to compounding and funding costs.

- Position sizing: Risk ≤ 0.5–1% of account; calculate shares by risk ÷ stop distance.

Example

- Account $25,000; risk 1% = $250.

- SQQQ price $20; ATR(14) ≈ $0.80.

- Stop = $18.80 (1.5×ATR below entry).

- Shares ≈ 208; notional ≈ $4,160.

Hedging a QQQ portfolio with SQQQ

- SQQQ targets −3x DAILY QQQ moves.

- For one-day hedge: buy ≈ 1/3 QQQ exposure.

- E.g., $90k in QQQ → buy ≈ $30k of SQQQ (rebalance frequently).

- Hedging drifts due to compounding; recheck sizing daily for tight hedges.

Scenario map for SQQQ use

| Scenario | Tactics |

|---|---|

| Bear trend (best) | Stagger entries on failed bounces; trail stops. |

| Sharp correction | Buy on break of support; take profits on panic spikes; don’t overstay. |

| Chop (worst) | Avoid or use defined-risk options instead of shares. |

Alternatives to consider

| Ticker | Exposure | Use case | Notes |

|---|---|---|---|

| PSQ | −1x QQQ | Conservative hedge | Less decay, simpler sizing |

| QID | −2x QQQ | Moderate leverage | Middle ground |

| SQQQ | −3x QQQ | Aggressive, short-term | Highest decay risk, tight risk rules |

| QQQ puts | Defined risk | Event hedges | Requires liquidity and expiry management |

| Short QQQ | Direct short | No daily reset | Unlimited loss risk |

Safer bearish strategies

- Raise cash and stablecoins to preserve dry powder.

- Use non-leveraged inverse ETFs (like PSQ) for smoother hedges.

- DCA into quality assets during downturns instead of gambling on inverse ETFs.

Costs and risks to respect

- Daily reset and path dependency cause decay in sideways markets.

- Higher expense ratios and trading spreads than plain ETFs.

- Overnight gap risk from earnings or macro data.

- Frequent trades can lead to short-term capital gains tax.

Common mistakes

- Treating SQQQ as a long-term investment.

- Oversizing based on cheap share prices.

- Premature entry without confirmation.

- Ignoring broader market context (breadth, credit, volatility).

- Forgetting stop-loss and bracket orders (reduce-only, OCO).

Quick copy-paste template

- Thesis: QQQ below 200-day MA; RSI < 50; MACD down; rising VIX.

- Entry: Buy SQQQ on QQQ breakdown or failed rally into 20/50-day MAs.

- Risk: 0.75%; stop 1.5×ATR.

- Take profit: +1R scale; trail remainder to +2–3R or exit on QQQ RSI > 50.

- Review daily; flatten if QQQ reclaims 50-day MA with momentum.

FAQ

- Can I hold SQQQ for months? Technically yes, but decay and compounding erode returns unless QQQ trends down persistently.

- Why not short QQQ? Shorting needs margin, has unlimited loss risk; inverse ETFs cap losses but have decay.

- Is timing everything? Yes—combine technical confirmation with macro context for best results.