Appearance

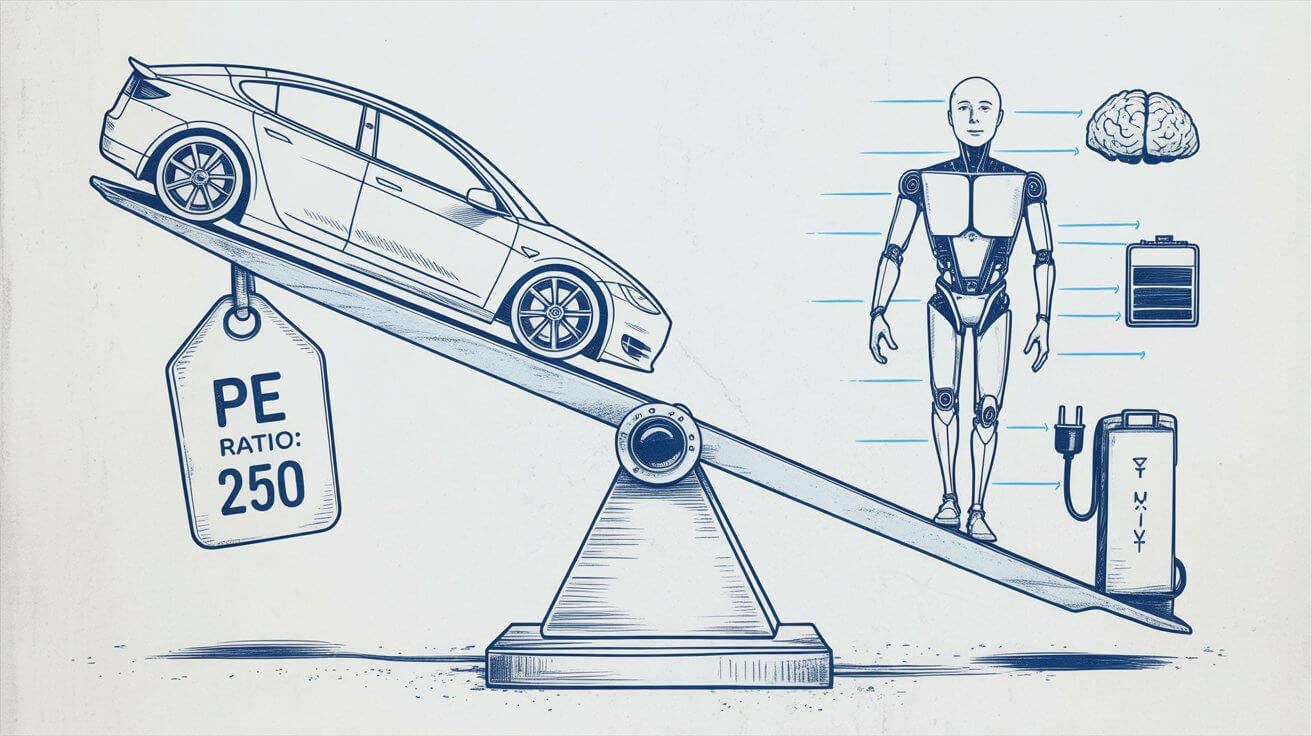

Are Buyers Crazy or Genius? Elon Musk’s Net Worth “$500B” vs. Tesla at 250x P/E

Overview

A triple-digit P/E screams “bubble” to value investors, yet growth investors argue Tesla is no longer just an automaker: it’s autos + energy storage + software (FSD/robotaxi) + AI/robotics. Whether buyers are crazy or genius depends on which cash-flow path you think is most plausible—and how quickly earnings can grow to justify today’s multiple.

Key takeaways

- A 250x P/E implies the market is pricing in massive, sustained EPS growth or large, high-margin new businesses (software/robotaxi/AI).

- If EPS grows fast enough, today’s P/E can compress to normal levels without price falling. If growth disappoints, the multiple collapses.

- Watch the three levers: delivery growth and auto margins, energy storage scale/margins, and FSD/robotaxi monetization and attach rate.

What a 250x P/E is “pricing in” (rough math)

- If the share price stays flat and the P/E compresses from 250 → 25 in 5 years, EPS must rise 10x.

- EPS CAGR needed ≈ 58.5% per year.

- If the “terminal” P/E is 40 (still growthy), EPS must rise 6.25x in 5 years.

- EPS CAGR needed ≈ 44% per year.

- Conclusion: To be “genius,” buyers need confidence in multi-year 40–60% EPS CAGR via new, higher-margin lines—not just car volume.

Bull vs. bear playbook

| Thesis | Bulls say | Bears say | What to track |

|---|---|---|---|

| Autos | Scale + manufacturing edge expand operating margins with cost/ASP management | EV competition + price cuts compress auto margins; autos revert to cyclical | Deliveries, ASPs, automotive gross margin ex-credits, inventory turns |

| Energy Storage | Megapack/Powerwall scaling with improving margins creates a second profit engine | Storage is capital intensive; margins depend on lithium/pricing cycles | Deployed GWh, backlog, gross margin trajectory |

| FSD/Software | High-margin software (subscription/licensing, robotaxi rev share) unlocks “tech multiple” | Full autonomy timelines slip; regulation and safety limit monetization | FSD take rate, paid MAUs, regulatory milestones, miles between interventions |

| AI/Robotics | Dojo + Optimus open enormous TAMs beyond autos | Speculative; costs today, unclear commercialization | Capex on compute, pilot programs, external customers, unit economics |

| Capital & Moat | Talent, brand, charging network, vertical integration | Incumbents catch up; regulatory and geopolitical risks | Supercharger revenue/partners, regional share, policy shifts |

What would justify “genius” pricing in 2025–2030?

- Autos: Sustained volume growth with automotive gross margin stabilizing/improving.

- Energy: Rapid GWh deployments with mid-20s% gross margin and strong backlog.

- FSD: Millions of paying users or licensed stack; recurring revenue with 70–85% software margins.

- Capital efficiency: Positive free cash flow after AI/capex investments; visible operating leverage.

What would prove “crazy”?

- Flat/declining EPS due to price cuts and rising costs.

- Energy growth but low margins and working-capital drag.

- FSD adoption stalls; regulatory restrictions limit monetization.

- Equity dilution to fund large capex with limited ROI.

Scenario map (illustrative—replace with your base cases)

| Scenario (5-yr view) | EPS CAGR | “Terminal” P/E | Implied multiple path | Read-through |

|---|---|---|---|---|

| Autos+Energy only | 20–25% | 25–35 | 250→40+ unless price falls | Multiple likely compresses; price depends on EPS growth vs. compression |

| FSD moderate adoption | 35–45% | 35–45 | 250→~45 with flat price | Buyers not crazy if FSD revenue scales |

| Robotaxi/AI hits | 50–60%+ | 45–60 | 250 stays elevated while EPS explodes | “Genius”—requires major regulatory/tech wins |

Trading and investing angles (educational, not financial advice)

- Neutral/hedged: Collar a long (covered calls + protective puts) into catalysts (deliveries, earnings, AI/FSD updates). Pair trade: long a profitable auto/energy/storage peer vs short TSLA to isolate multiple risk.

- Bullish but disciplined: Accumulate on pullbacks when auto GM ex-credits improves and FSD metrics inflect. Use call spreads over long-dated calls to manage premium in a high-IV name.

- Bearish/valuation focus: Put spreads around earnings if deliveries miss and margins compress. Fade rallies into key resistance when breadth/real yields are headwinds.

5 numbers to watch each quarter

- Automotive gross margin ex-credits

- Energy storage deployments (GWh) and gross margin

- FSD paid users/attach rate and ARPU

- OpEx vs. revenue growth; FCF after capex/AI spend

- Share count/dilution and net debt/cash

Macro context that matters

- Real yields and USD: higher real yields compress growth multiples.

- Input costs (lithium, nickel) and energy prices: margin sensitivity.

- Regulation: autonomy approvals/recalls; subsidies/tariffs shaping regional demand.

What This Means For You

As an investor, you must decide which narrative you subscribe to. Investing in Tesla is not like buying a blue-chip stock like Coca-Cola. It requires a high tolerance for volatility and a deep conviction in a future that is far from guaranteed.

The next time you see Tesla's PE ratio, don't just see a number. See the story it tells: a story of a market locked in an epic struggle between historical fundamentals and a radical vision for the future. Whether that vision becomes reality will determine who was the genius, and who was the fool.